Welligence is everything you need in O&G and Energy Transition data and analytics. Combined with things you never thought possible.

Unlike any other market intelligence firm.

Asset coverage and valuations, interactive mapping interface,

integrated GHG analytics, detailed overviews and industry trackers

based on the highest quality data, delivered in a way no other company can.

Maximize opportunity with the market’s most comprehensive and current data.

Data-driven decision making, accelerated by AI.

Our subscription-based service is delivered by the most respected experts in the industry, keeping you ahead of the competition.

Coverage includes:

Latin America | US Gulf of Mexico | Africa | North Sea | Middle East | Asia-Pacific

The Perfect Research Platform for

Energy Companies

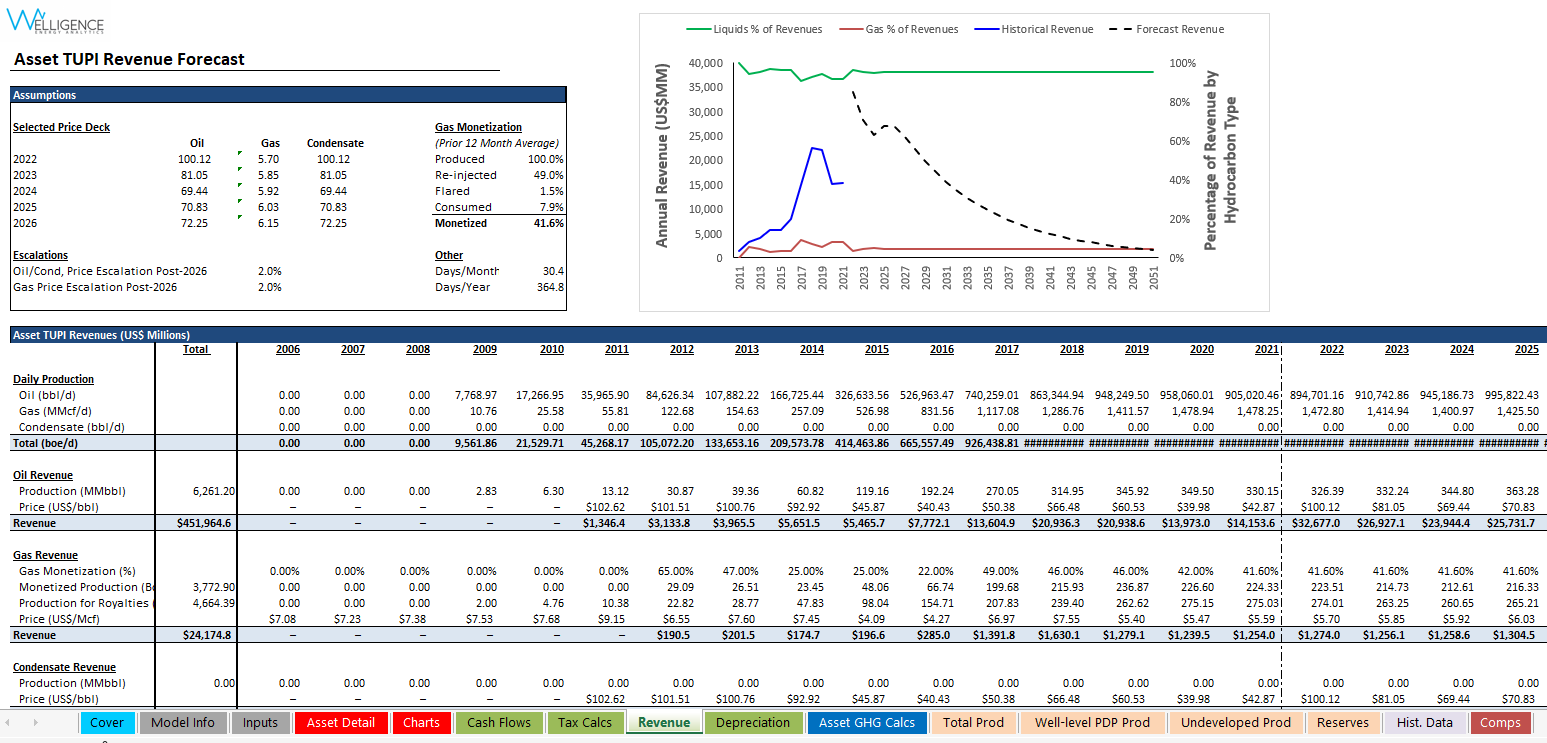

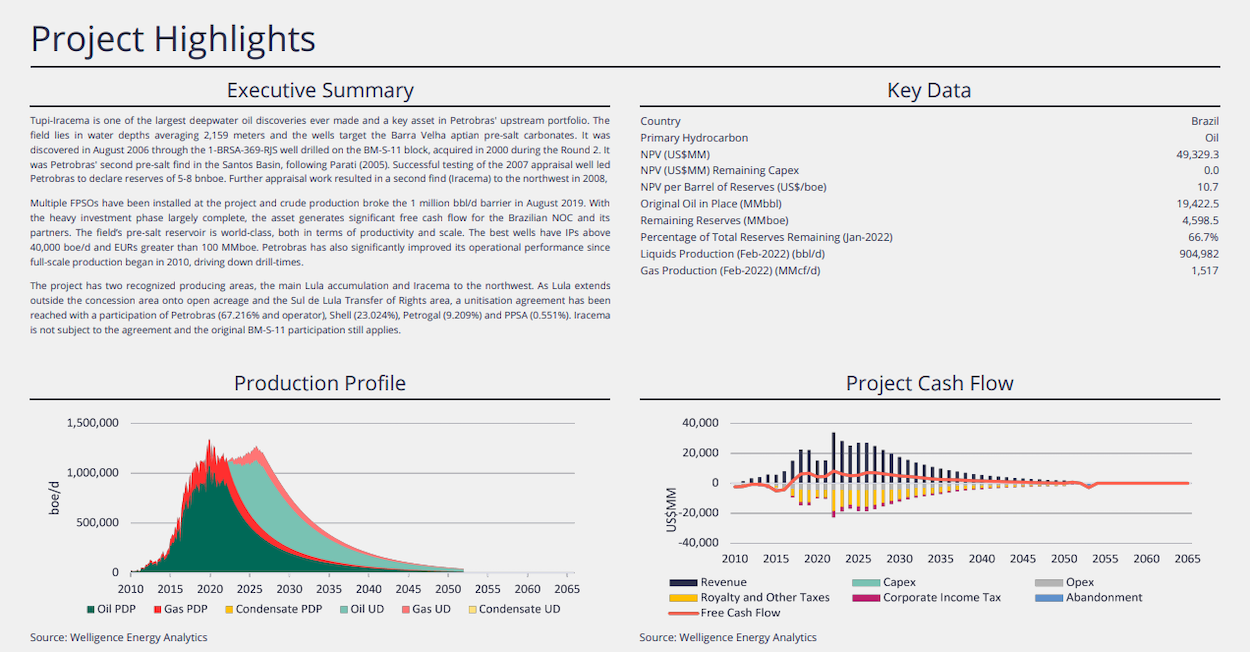

Welligence delivers technical data and deep analysis for ~3,000 commercial upstream assets, while covering every regional exploration block. Efficiently screen and identify opportunities, benchmark against your competitors’ portfolios, evaluate economic impacts of GHG emissions and mitigate risks by building credible commercial asset valuations.

Financial Institutions

Stay ahead of the curve. Your competitors have already said goodbye to underwhelming, outdated research – are you ready to make the jump? Maintain your competitive edge with coverage of more assets, unique insights, emissions analytics, advanced forecasts, and granular up-to-date data.

The Core

Welligence empowers better decisions.

Detailed Overviews

Detailed Overviews

Explore nearly three thousand assets in detail to understand commerciality, development history and outlook, detailed production and reserve estimates, and much more to inform your acquisition or strategic positioning approach.

Analytics And Visualizations

Valuation Models

Monthly Updates

Intelligence

Up to the minute commentary on trends impacting the upstream sector - exploration discoveries, deal notes, licensing rounds, M&A, strategic trends, key player intel and weekly discussion pieces

Canada Oil Sands M&A | Cenovus acquires MEG Energy for US$5.71 billion, advancing Canadian oil sands consolidation

On 22 August 2025, Cenovus Energy announced an agreement to acquire MEG Energy for US$5.71 billion (C$7.9 billion). CLIENT ACCESS REQUEST ACCESS

Welligence | Weekly Quick Takes

This report provides our clients with access to the key postings on our LinkedIn page. It is regularly updated, with the most recent posts sitting.

From Bridge to Backbone – Turning LNG’s Methane Risk into Opportunity

The boom in new LNG plants, particularly in the US, has raised concerns among environmentalists about methane emissions, prompting claims that LNG is “worse than.